Property Built a Generation of Wealth PropTech and AI will build the next

If you Build Wealth through Property... The next big Opportunity is creating PropTech Companies with AI...

The fastest path to generational wealth in 2026 isn’t property, stocks, e-commerce or crypto… It’s owning the PropTech platforms being built with AI right now. In the next 12-24 months, you either own the platform - or you work inside someone else's... The PropTech Gold Rush is here...

PropTech Value Multipier System

Here's how it works

Traditional property companies trade at just 2-3x profits, but we're helping you pivot to an astonishing 15x profits. Our system is architecting this future by weaving together your human capital and cutting-edge AI capabilities, guaranteeing maximum value potential, productivity, and innovation to secure that 15x valuation for your business.

Step 1: Buy a Traditional Property Company for 2–3× EBITDA

We can show you how to do this without using any of your own money

Step 2: Convert It Into a PropTech Company Worth 15× EBITDA

Harness the power of automation & agentic AI to increase efficiency and achieve the 15x valuation.

Step 3: Sell for a Massive Profit, Build a PropTech Portfolio, or Sell 20% to an Investor

My system delivers maximum flexibility and value realization, ensuring the future of your wealth is entirely in your control.

You Can Do This Even If...

✔ You already own a business

If you already own a business and are eager to take it to the next level, we will provide you with the insights and tools necessary to harness the power of AI. Together, we will explore strategies that not only enhance your operations but unlock new avenues of success.

✔ You’ve never used AI before

If you’re just starting out, let us help you leverage strategies that can scale your business by up to 15X. We will work closely with you to ensure that you not only understand AI, but also harness its power to drive your business growth.

✔ You’ve never acquired before

We are here to support you learn how to flip companies effectively. Our tailored consulting sessions provide you with the critical tools to excel. Together, we’ll break down the complexities and drive your success in every deal you make.

Interested to learn more?

Pre-register for the Next Masterclass in January 2026

We're organizing a 90-minute Masterclass to teach you the 15X Value Multiplier System and the strategies needed to transform your business into a high-valuation tech company. This program is essential for business owners aiming for higher valuation, greater automation, reduced manual work, better margins, more time freedom, and a faster exit or easier acquisition. Since seats are limited, you must register immediately to secure your spot.

Date and time is TBDVirtual Masterclass

Date and time is TBDVirtual Masterclass

Flipping Companies = Flipping Properties... but on Steroids

In the Masterclass, You’ll Discover:

Module 1

Why your company is worth 3X today - and how to make it worth 15X?

Module 2

How to buy businesses without your own money - then convert them?

Module 3

Digital employees (Agentic AI Agents) doing 70–80% of the work

Module 4

Human-In-The-Loop safety (more reliable than human-only teams

Module 5

How tailor-made AI IP (intellectual property) increases valuation?

Module 6

How to eliminate mundane tasks & free your time to focus on growth?

Module 7

Proof that Paul is building this in his own companies and has seen great success

Module 8

All about Paul’s 3 business books and how you can obtain a free copy

Module 9

Your exit options: sell 100% or just sell 20% for what 100% used to be worth

Module 10

The EBITDA example (a £600k Company converted into a £3m Company)

Module 11

Flipping companies is the new flipping properties - learn how you can do this

Module 12

What PropTech unicorns did right - and how SMEs can copy them?

Module 13

Plus; I'll show you how to access £150k investment and £10k–£15k/m new income stream

The AI Revolution Will Change Your Life

Elon Musk

“AI will be the most disruptive force in history. Jobs? Wealth? Entire industries — everything will be transformed.”

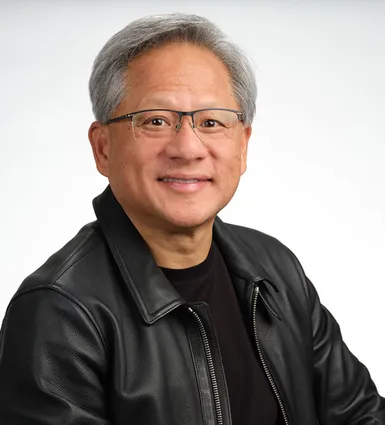

Jensen Huang

"AI will create more millionaires in the next 5 years than the internet did in 20 years"

Bill Gates

“AI is the biggest technological advance in decades. It will change how people work, learn, travel, get healthcare, and communicate.”

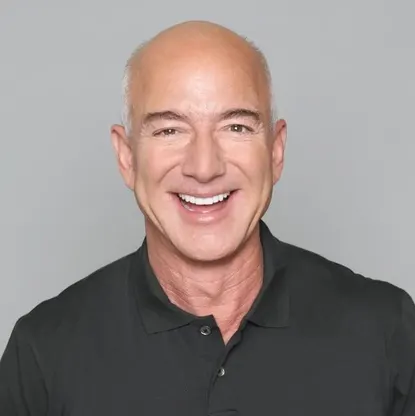

Jeff Bezos

“We’re at the earliest stage of AI. It will be everywhere — creating extraordinary businesses in every sector.”

Learn More

Why This Model Is Creating More Millionaires Than Anything in Property Right Now?

The shift from a traditional business model to a Tech-enabled model dramatically increases valuation multiples. While conventional property companies typically sell for 2–3x EBITDA, incorporating the PropTech model allows businesses to command valuations of 15x EBITDA.

This means that a business generating £200k in EBITDA, which would be valued at only £600k as a traditional entity, is instead worth £3,000,000 simply by adopting a technology-driven structure, demonstrating that the same core business and team can achieve a five-fold higher valuation through a different operating and valuation model.

I'M PAUL JOHNSON - CREATOR OF THE AiGM SYSTEM

I aim to Multiply 100 Businesses to 15x by 2030!

I'm a Chartered Accountant and M&A specialist with decades of experience in buying and selling global companies and creating 8-figure businesses. As the Founder of AiGM™ and an AI Business Strategist, I help business owners boost their company's value in under 12 months using 'The AiGM™ Agentic Operating System'.

Isn't it time for you to reach your apex? Your greatest success is just around the corner.

Modern entrepreneurship carries a heavy burden, particularly for traditional property businesses that must manage legacy assets while simultaneously striving for rapid, unprecedented scale in a digital market. The future of AI in business offers both a strategic tool to scale up value and a viable solution to our most pressing global challenges.

ARE YOU INTERESTED – BUT YOU'RE NOT IN PROPERTY?

If You Run a Business With Employees and Operations...

This Works For You

Traditional law firms are valued lower (3x–4x profit) due to dependence on billable hours, but layering on LegalTech tools like AI and automation transforms them into scalable platforms. This conversion allows acquisition at a low multiple, scaling as a technology-enabled legal service, and exiting at a high LegalTech valuation (12x–20x), mirroring the PropTech investment model.

Traditional construction companies are valued low (2x–4x earnings), but integrating BuildTech solutions like AI scheduling, digital twin tools, and predictive analytics transforms them into technology platforms. This allows for purchasing at a low construction multiple, implementing tech for scalability, and exiting at a high BuildTech valuation (10x–15x).

Traditional training companies, typically valued low (2x–5x), can be transformed into high-valuation EduTech businesses by implementing Agentic AI. This transition involves shifting from selling hours to offering scalable intellectual property via AI-driven learning pathways, automated content creation, and digital subscription academies, enabling the high 3x →15x valuation increase.

Recruitment agencies are typically valued low (3x–4x profit), but by integrating RecruitTech solutions like AI-based candidate matching, automated outreach, and talent-pool databases, they can be transformed. This process converts the people-heavy agency into a technology-driven engine, allowing private equity to pay a premium valuation of 12x–18x.

Traditional clinics are valued low (2x–4x profit), but integrating Agentic AI for automated patient onboarding, AI triage, and remote monitoring transforms them. This conversion shifts the clinic from a service provider to a scalable HealthTech platform, dramatically increasing its valuation to the 10x–20x range and improving exit opportunities.

Traditional financial services firms are typically valued low (3x–5x), but applying Agentic AI can transform them into high-value FinTech engines. This transformation involves implementing tools like automated financial reporting, loan qualification engines, and risk scoring, which creates subscription revenue, data assets, and proprietary technology, thereby dramatically increasing the firm's valuation, potentially exceeding 20x.

Consultancies are typically valued low (2x–4x), but they can be converted into high-value BizOpsTech and Operational AI platforms through systemization. Implementing tools like AI-powered SOPs, automated delivery systems, and client dashboards transforms the firm from relying on people to scalable systems, allowing investors to buy low and exit at a high multiple (10x–15x).

Operational service businesses (trades, cleaning, security, etc.) are typically low-valued (2x–4x profit), but integrating technology like AI scheduling, route optimization, automated customer service, and digital reporting transforms them. This conversion creates Tech-Enabled service platforms with recurring contracts and subscription revenue, making them attractive acquisition targets for private equity at much higher valuations

Any business with people, processes, operations, or customers can be converted into a high-valuation Tech-Enabled asset. This the 3-step model works across every sector.

Flip Companies On Steroids